Real Property Gains Tax RPGT is charged on gains arising from the disposal of real property situated in Malaysia or of interest options or other rights in a property as well as the disposal of shares in real property companies RPC. Central Bank of Malaysia.

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

A tax levied on profit from the sale of property or of an investment.

. As such RPGT is only applicable to a seller. While non-Malaysians will be levied with 30 of RPGT. However for individuals selling or disposing their property after the 5th year no RPGT will be levied.

Nevertheless it has also gone through several changes over the years and was even suspended temporarily. Seri Pacific Hotel Kuala Lumpur Time. REAL property gains tax RPGT is a tax charged on gains arising from the disposal or sale of real property or shares in a real property company RPC.

WS001 COURSE DESCRIPTION In a lively property market Malaysia presents many opportunities to take advantage of appreciating property values and it is important to understand the tax planning. Currently gains from the disposal of property under the Real Property Gains Tax Act 1976 are assessed formally. The basics and the advanced Date.

900am to 500pm Event Code. RM100000 property gains RM10000 waiver RM90000 taxable gains This tax is exempted when the property in question is given as a gift between parent and child husband and wife and grandparent and grandchild. Disposal Date And Acquisition Date.

Every person whether or not resident is chargeable to RPGT on gains arising from disposal of real property including shares in a real property company RPC. Real property is defined as any land situated in Malaysia and any interest option or other right in or over such land. The Real Property Gain Tax RPGT is a tax chargeable on the profit gained from the disposal of a propertys in Malaysia which is payable by a seller.

That is the highest rate of the sliding scale of gains tax payable when a landed property is sold one year after the death of the deceased. Unannotated Statutes of Malaysia - Principal ActsREAL PROPERTY GAINS TAX ACT 1976 Act 169REAL PROPERTY GAINS TAX ACT 1976 ACT 1692Interpretation. Short title and commencement.

According to Real Property Gains Tax Act 1976 RPGT is actually a form of Capital Gains Tax levied by the Inland Revenue LHDN on chargeable gains derived from the disposal of real property in this case your land or building. Real Property Gains Tax RPGT Rates. 2016 REAL PROPERTY GAINS TAX MALAYSIA wwwhasilgovmy LEMBAGA HASIL DALAM NEGERI MALAYSIA LHDNMR1316 INTRODUCTION Real Property Gains Tax RPGT is charged on gains arising from the disposal sale of real properties or shares in Real Property Companies RPC SUBMISSION OF RPGT FORM DISPOSAL NOT LIABLE TO RPGT.

RGPT was first introduced by the Malaysian Government under the Real Property Gains Tax Act 1976 to curb speculative activities in the property market. 7 November 1975 BE IT ENACTED by the Seri Paduka Baginda Yang di-Pertuan Agong with the advice and consent of. In tandem with the Governments aspi ration to modernise the tax syst em it was proposed in Budget 2015 that tax on gains from the disposal of property be self-assessed by the taxpayer effective from the year.

Understanding How Real Property Gains Tax RPGT Applies To You In Malaysia. For example A bought a piece of property in 2000 at a value of RM500000. The property tax is levied upon anyone selling their properties.

Real Property Gains Tax 7 LAWS OF MALAYSIA Act 169 REAL PROPERTY GAINS TAX ACT 1976 An Act to provide for the imposition assessment and collection of a tax on gains derived from the disposal of real property and matters incidental thereto. Part III Schedule 5 RPGT Act. This Act may be cited as the Real Property Gains Tax Act 1976 and shall be deemed to have come into force on 7 November 1975.

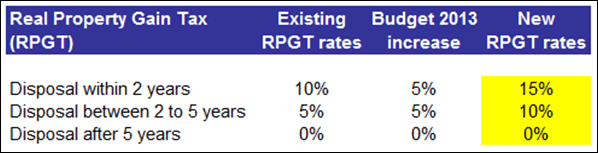

Disposer who is not citizen and not permanent resident or an executor of the estate of a. Up to 31 December 2018 persons subject to tax under Part I of Schedule 5 enjoyed a zero-rate if they disposed of chargeable assets after a minimum holding period of five complete years. Disposer is a company incorporated in Malaysia or a trustee of a trust or body of persons registered under any written law in Malaysia.

For example if the gain in disposing of the property was RM100000 the gains tax payable would be RM30000. REAL PROPERTY GAIN TAX. RPGT Payable Nett Chargeable Gain x RPGT Rate.

For example if you bought a house for RM250K and sell it at RM350K the profit of RM100K is chargeable under RPGT but you may be entitled to deduct expenses such as. Youll pay the RPTG over the net chargeable gain. The tax is calculated as such.

Tax payable Net Chargeble Gain X RPGT Rate based on holding period RM171000 X 5. 6th year above. RPGT is payable only after the property has been sold.

New Companies Act to focus on better corporate governance The Edge August 8 to 14 2016 updated MH Law on Impact of Companies Bill 2015 to Entrepreneurs - BFM updated 31 January 2017 MH Law on Understanding rights and. RPGT is calculated based on the gains between the selling price and original purchase. An RPC is a company holding real property or shares in another RPC which value is not less than 75.

In addition our government also make an announcement on 5th June 2020 as to the several incentives as part of their strategy to stimulate the property market which including real property gains tax RPGT exemption for Malaysia citizens for disposal of up to three 3 properties between 1st June 2020 and 31st December 2021 as Malaysia enters the Recovery. A real property transaction subject to zero-rating means it is properly subject to RPGT but is subject to tax at the rate of zero if the requisite conditions are satisfied. It is the tax which is imposed on the gains when you dispose the property in Malaysia.

Subsequently A man sold the property to A girl at the value of RM700000 then the. Real Property Gains Tax. He has to pay gains tax at the rate of 30 of the gain.

RPGT stands for Real Property Gains Tax. If you owned the property for 12 years youll need to pay an RPGT of 5. 11 January 2016 Venue.

It was the first-ever form of capital gains tax and to this day remains the only form of capital gains tax in Malaysia. 34 Capital gains taxation 35 Double taxation relief 36 Anti -avoidance rules 37 Administration 40 Withholding taxes 41 Dividends 42 Interest 43 Royalties 44 Branch remittance tax 45 Wage taxsocial security contributions 46 Other withholding taxes 50 Indirect taxes 51 Goods and services tax 52 Capital tax 53 Real estate tax 54. RPC is essentially a controlled company where its total.

RPGT is a tax chargeable on the profit gained from the disposal of a property and is payable to the Inland Revenue Board. In simple terms a real property includes land or immovable property with or without title. Disposal Price And Acquisition Price.

The executor sold the property in 2006. Companies however will pay a flat rate of 5 starting on the 6th year and thereafter. Typically a 60 day window is provided.

For example A man bought a piece of property in year 2000 at a value of RM500000.

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

.jpg)

Financing And Leases Tax Treatment Acca Global

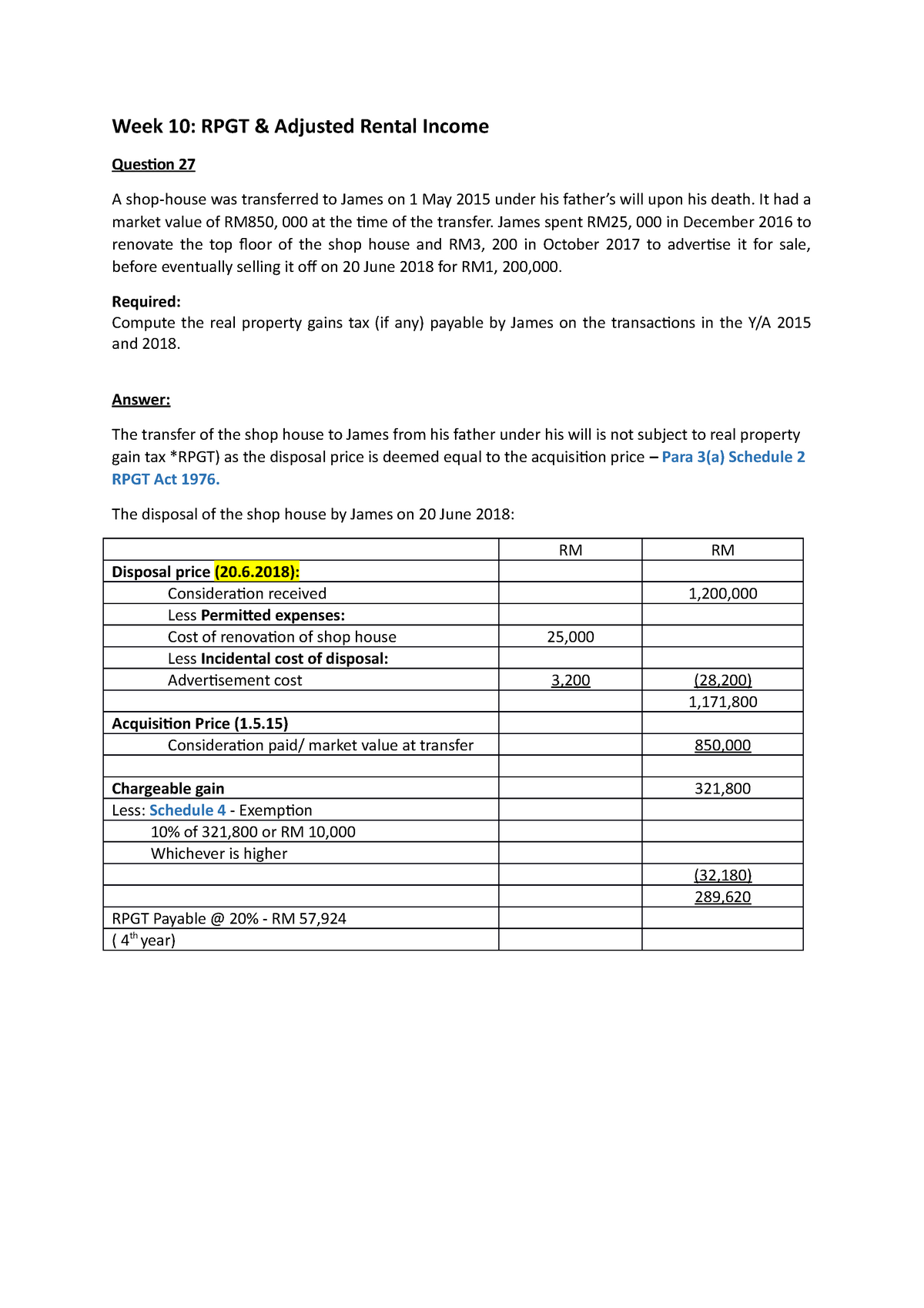

Budget 2013 Real Property Gain Tax Rpgt Increased To 15

What Is Real Property Gains Tax The Malaysian Bar

Real Property Gains Tax Rpgt In Malaysia Tax Updates Budget Business News

Taxation On Property Gain 2021 In Malaysia

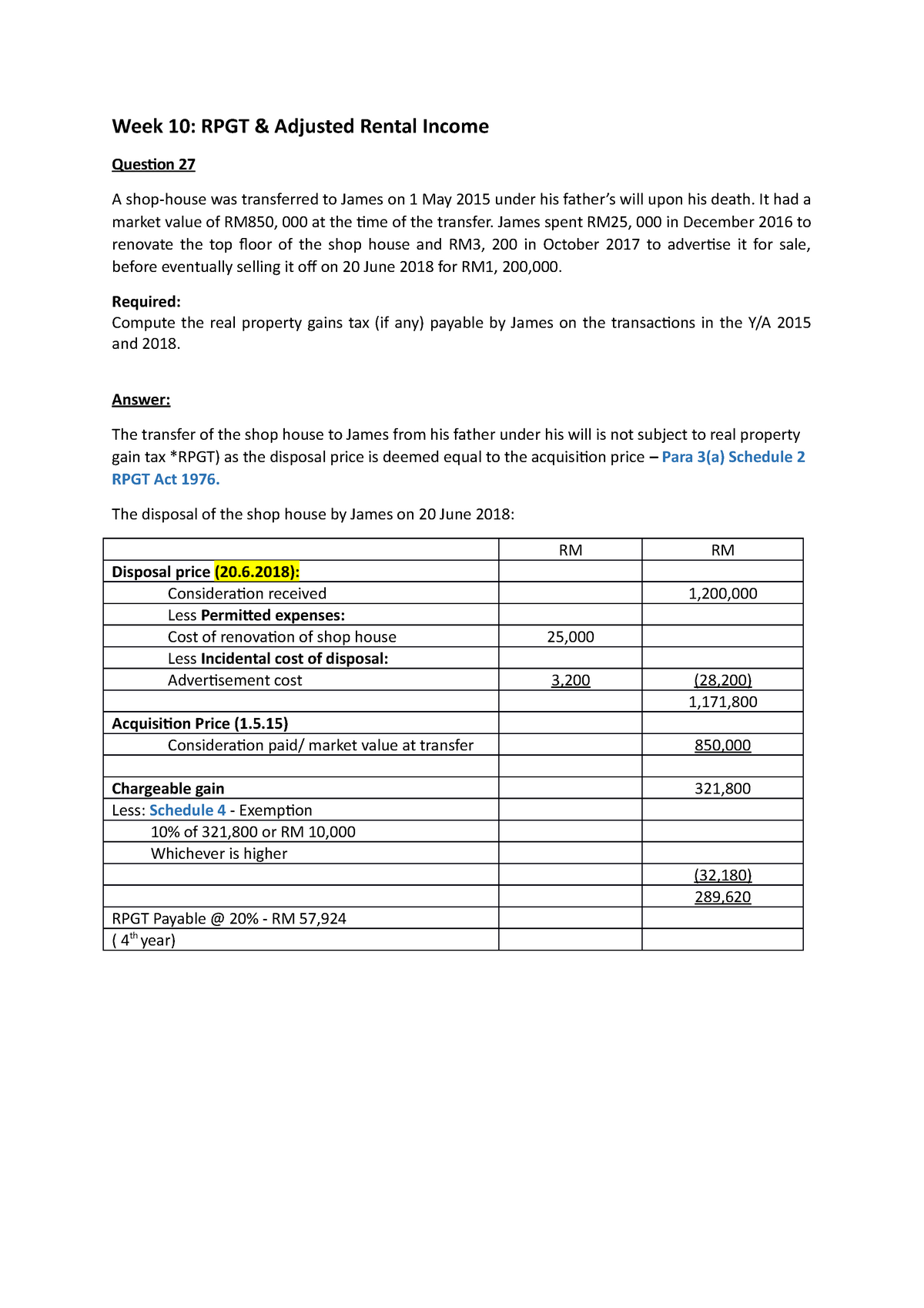

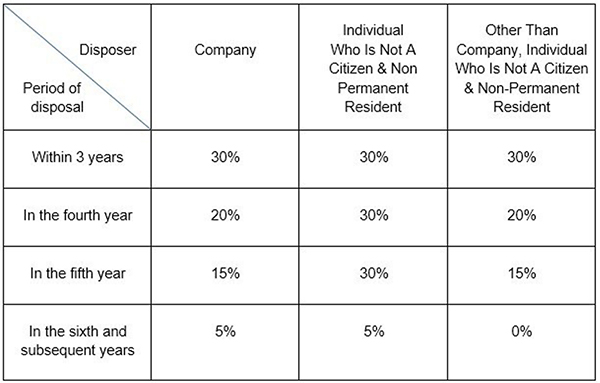

Rpgt Rpgt Answers Week 10 Rpgt Amp Adjusted Rental Income Question 27 A Shop House Was Studocu

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia

Taxation On Properties Rpgt Company Shares Mypf My

Real Property Gains Tax After Death Rockwills Info

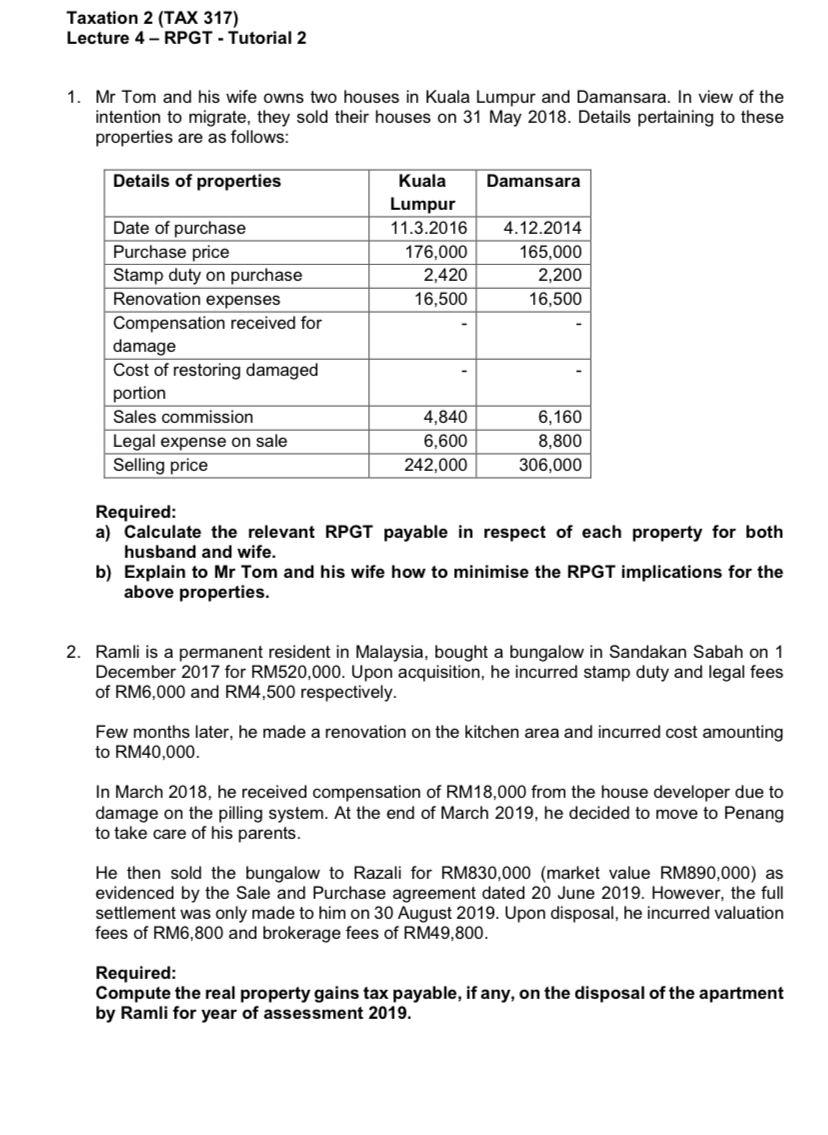

Taxation 2 Tax 317 Lecture 4 Rpgt Tutorial 2 1 Chegg Com

Real Property Gain Tax Rpgt Archives Tax Updates Budget Business News

Zerin Properties Real Property Gains Tax

Common Questions Answered For Expats Investing In Malaysian Property

Real Property Gain Tax Rpgt 2020 Malaysia Housing Loan

Real Property Gains Tax Rpgt In Malaysia Malaysia Taxation

Understanding How Real Property Gains Tax Rpgt Applies To You In Malaysia